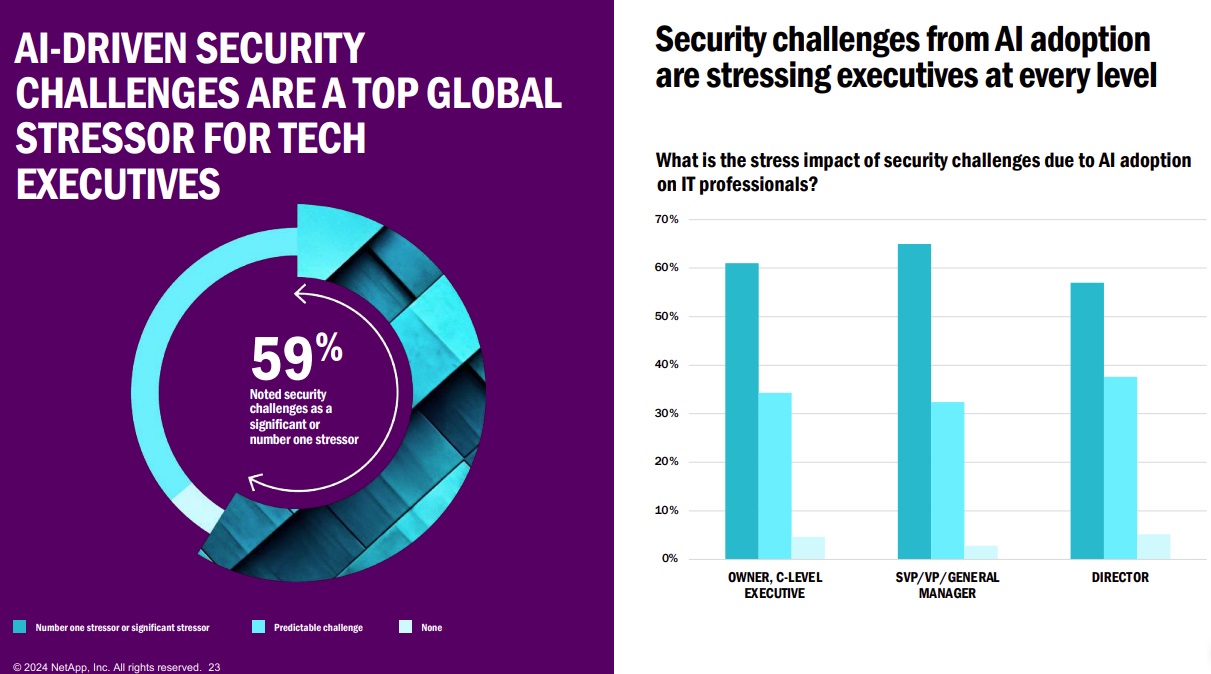

Execs Worry About AI Increasing Security Threats

Also, the company said, "there's a silver lining: the strategic measures organizations have implemented appear to be paying off. The focus on cybersecurity as a top priority has decreased by 17% since 2023 -- a promising sign that progress is being made in combating these ever-evolving threats."

Other highlights of the report as presented by the company include:

- AI Investment: Will AI Break the Bank? Two-thirds of companies worldwide report that their data is either fully or mostly optimized for AI -- meaning their data is accessible, accurate, and well-documented for AI-use cases. However, despite this progress, 2025 will still demand investment in AI and data management.

- Data Silos: Will Your Data Impede AI Success? Data unification is emerging as a critical driver of AI success, with 79% of global tech executives recognizing the importance of unifying data to achieve optimal AI outcomes.

- Data Sustainability: Is AI Putting the Planet at Risk? As AI adoption accelerates, 34% of global tech executives anticipate major shifts in corporate sustainability processes, and 33% expect new government energy policies and investments.

"2025 will be a make or break year for AI to achieve world changing outcomes -- in some cases for better, in some for worse," NetApp said. "In an effort to surpass competition, global business leaders and organizations will make remarkable investments to fully optimize their data for AI in 2025.

"From AI talent to data management and infrastructure, all eyes will be on technology teams to deliver exceptional return on investment. But as AI scales, so too will security threats and sustainability challenges. Companies will be under incredible pressure as they aim to strike the critical balance between AI transformation, security and sustainability."

As far as methodology for the new report, NetApp said it partnered with Wakefield Research to conduct a quantitative research study during November 2024 among more than 1,300 IT executives in nine markets: US, EMEA (UK, France, Germany, Spain) and APAC (Australia/New Zealand, Singapore, India and Japan).

David Ramel is an editor and writer at Converge 360.